Insurance plans, including Medicare, often cover at least some of the costs of continuous positive airway pressure (CPAP) therapy used to treat obstructive sleep apnea. However, in many cases, certain requirements must be met in order to qualify for coverage.

What CPAP Equipment Does Insurance Cover?

Insurance often provides at least partial coverage for CPAP machines and necessary accessories if your doctor has diagnosed you with obstructive sleep apnea (OSA) after an overnight sleep study.

OSA can cause serious health problems if left untreated, and treatment with a CPAP device is effective at improving sleep and raising quality of life. However, for CPAP therapy to work, the device must be used consistently. As a result, insurance coverage often requires evidence of compliant CPAP machine use.

While the amount you have to pay out of pocket can vary significantly based on the details of your insurance plan, most include coverage for the CPAP machine and essential accessories.

CPAP Machines

A CPAP machine generates pressurized air that is delivered through a hose and mask to keep your upper airway open during sleep. The device is usually covered by insurance if your doctor has prescribed CPAP therapy for sleep apnea.

It is important to get the details of your insurance plan’s coverage of the CPAP device itself. Your doctor or insurer may coordinate finding a CPAP machine or you may be responsible for getting a CPAP machine from a medical equipment supplier directly.

For many insurance plans, the CPAP machine is rented for a period of months, during which you must demonstrate that you regularly use the device. After the rental period, you own the machine.

The cost of a CPAP machine can vary based on the brand, model, and supplier. The average cost is between $500 and $1,000, but the price that a CPAP supplier bills to an insurance provider can be much higher.

Other types of devices used to treat sleep apnea, such as auto-adjusting PAP (APAP) or bilevel PAP (BPAP or BiPAP), may also be covered depending on your diagnosis and your insurance policy. These devices provide variable amounts of air pressure instead of the fixed pressure from a CPAP machine. APAP and BiPAP machines tend to be more expensive than CPAP devices.

CPAP Machine Parts and Accessories

When insurance provides coverage for a CPAP machine, that coverage typically extends to the supplies that are necessary to properly use the device. Several accessories are important to nightly CPAP therapy.

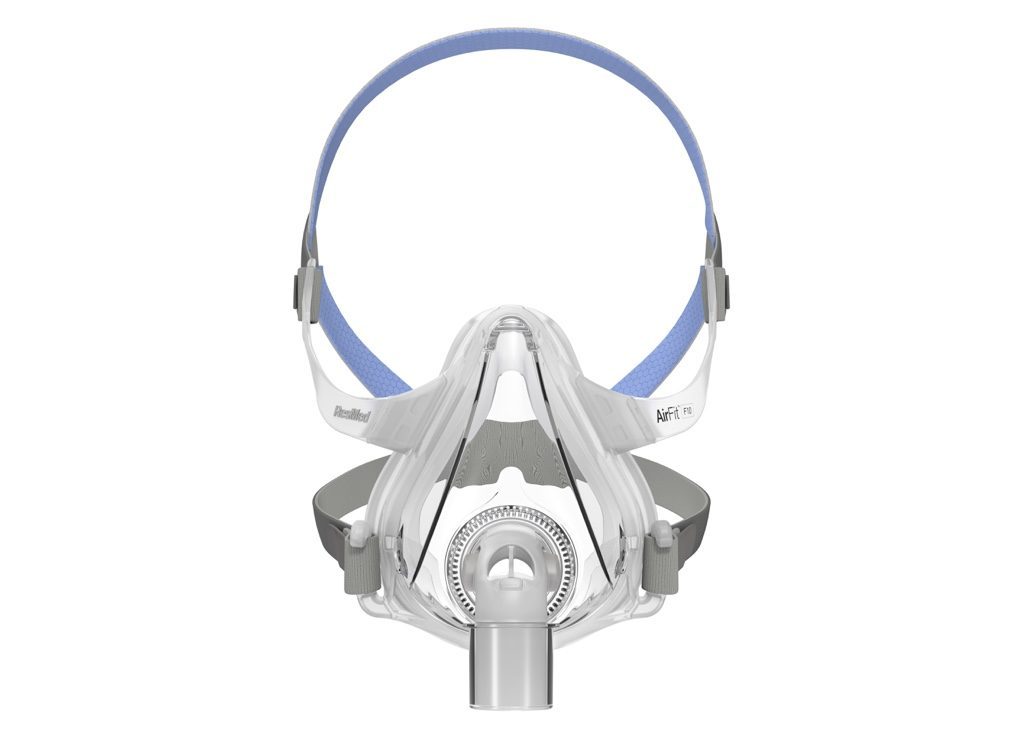

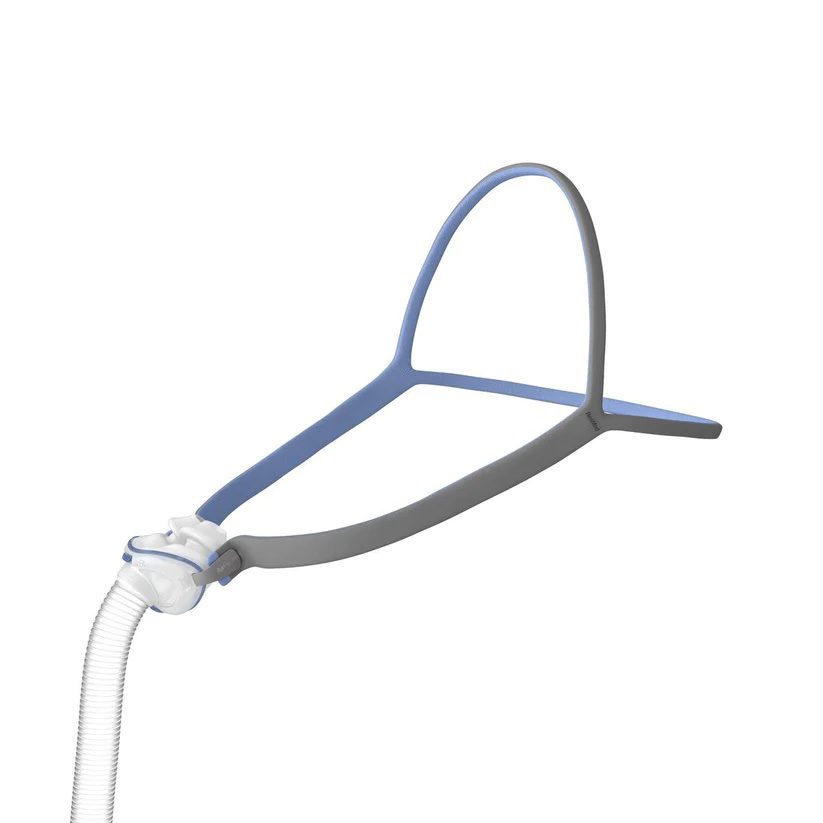

- Mask, cushion, and headgear: The mask cushion fits onto your face and attaches to the mask, allowing pressurized air to flow into the upper airway. Headgear keeps the mask in the right position.

- Tubing: The tubing connects the CPAP machine and the mask.

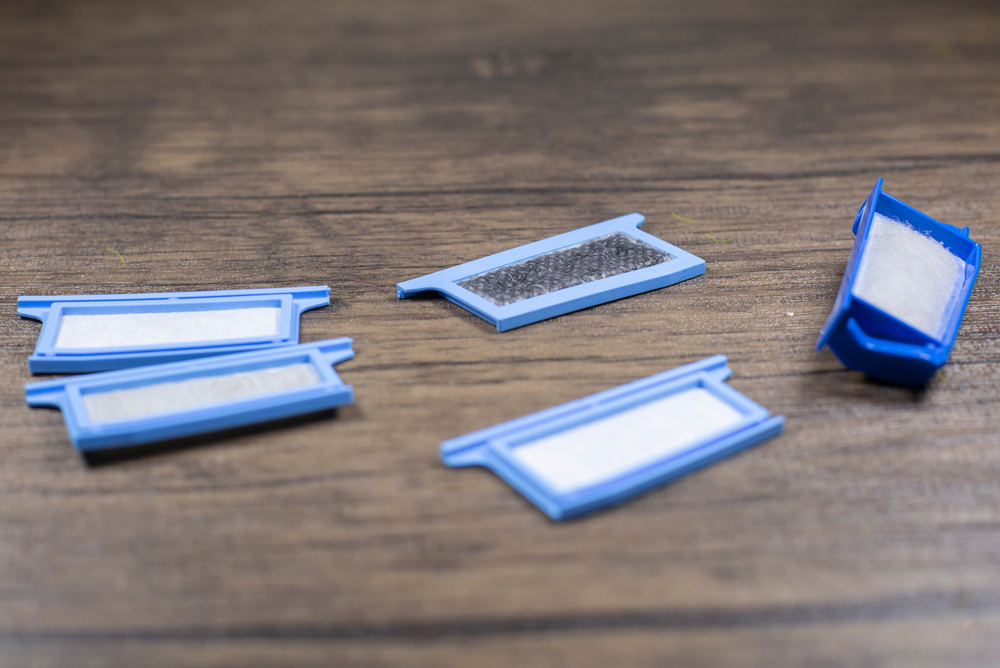

- Filter(s): Devices have at least one filter to keep unwanted particles out of the air that flows into the mask.

- Water tank: Humidifiers are now standard in most CPAP machines, and the tank holds water that can add moisture to the flow of air.

With regular use, these CPAP components need to be replaced at regular intervals. Insurance providers generally follow a schedule for covering the replacement costs if you are using your CPAP as directed by your doctor. If you need to replace any item more frequently, you may need to pay for it yourself.

The supplier of your CPAP equipment may bill your insurance for accessories at prices that are different from the prices found online. The price range is different for each accessory, and the cost of parts can vary based on your specific CPAP model.

| CPAP Part or Accessory | Average Cost |

|---|---|

| Mask with headgear | $50-$200 |

| Mask cushion | $20-$60 |

| Non-heated tubing | $5-$35 |

| Heated tubing | $30-$75 |

| Air filters | $5 or less |

| Water chamber for humidifier | $20-$50 |

While core accessories are generally included in health insurance policies, you may not have coverage for optional CPAP accessories. This includes things like CPAP cleaning wipes or detergents, specialty CPAP pillows, tubing holders, or other products.

What Are Typical Requirements for CPAP Insurance Coverage?

Before providing coverage for a CPAP machine and its accessories, insurance companies typically require proof that CPAP therapy is medically necessary. They may also require that you get health care services and equipment from a specific list of in-network providers.

Before beginning to cover CPAP equipment, insurers may require that several steps be completed by you, your doctor, and the equipment supplier.

- Initial doctor visit: You will need to meet with your doctor to review any sleep apnea symptoms that you have. Some insurers require that this be an in-person appointment.

- Sleep study: Based on your symptoms, your doctor can prescribe an overnight sleep study. During a sleep study, medical equipment tracks your breathing and other health-related data. Sleep studies are often conducted in a sleep laboratory, but at-home sleep apnea tests are an option in certain situations.

- Diagnosis: Coverage for CPAP therapy requires that you have been diagnosed with OSA by your doctor. After a sleep study, your doctor can review your symptoms and test results to determine if you meet the standard diagnostic criteria. OSA cannot be diagnosed without having a sleep study.

- CPAP education: Insurers may require that your doctor or the CPAP equipment supplier explain to you how the CPAP machine works and review the key steps for maintaining the device.

Insurance usually covers CPAP equipment for an initial period of a few months. After that, additional requirements often must be met for coverage to continue.

- Follow-up visit: Many insurance policies obligate you to have a follow-up appointment with your doctor to see how well CPAP therapy is working, and this may need to be a face-to-face appointment.

- Symptom improvement: Your doctor often will need to provide documentation that states that you have benefited from the use of CPAP therapy.

- Proof of consistent CPAP machine use: It is common for insurance companies to only continue coverage if you have clear evidence that you are compliant with the use of your CPAP machine. This often involves analyzing data that is collected by the CPAP machine itself.

Check with your insurance provider about their specific requirements for CPAP coverage. You can also work with your doctor and equipment supplier to prepare and submit documents required by your insurer.

Deductibles and Coinsurance

Even if your insurance covers CPAP equipment, you may have out-of-pocket costs from a deductible or coinsurance.

- Deductible: Your annual deductible is a fixed amount that you have to pay before your insurance starts covering any costs.

- Coinsurance: Coinsurance is a percentage of costs that your insurer requires you to pay even after you have met your deductible.

Deductible and coinsurance amounts vary based on your specific insurance plan. In some cases, high deductibles or coinsurance requirements can drive up your spending on CPAP equipment despite having insurance coverage.

For this reason, you should look closely at your insurance policy to determine how much you can expect to pay. You may have an out-of-pocket maximum that caps your spending in any calendar year.

Does Medicare Cover CPAP Machines?

Medicare provides coverage for CPAP machines and supplies for people who have been diagnosed with OSA by their doctor and who show that they are routinely using and benefiting from their CPAP device.

Medicare provides insurance to people who are over 65 years old or who have certain disabilities. Like most insurance providers, Medicare requires that you meet with a doctor, have a sleep study, and receive a diagnosis of OSA before covering CPAP therapy.

Medicare often covers the initial initial three months of a CPAP machine rental. After that, you and your doctor must demonstrate that you are regularly using the device and that your symptoms have improved. After 13 months of renting the CPAP machine, you become its owner, but Medicare will continue to cover supplies if you are consistently using the device.

During the initial 13 months of renting a CPAP, you should expect to have out-of-pocket costs because Medicare requires you to meet a deductible and then pay coinsurance of 20%.

For health care services and equipment to be covered, it is essential that your providers are registered with Medicare. For example, if your equipment supplier is not enrolled with Medicare, you may have to cover the entire bill even if your doctor has prescribed CPAP therapy.

Does Medicaid Cover CPAP Machines?

Medicaid may cover CPAP machines, but Medicaid coverage varies by state.

Medicaid is a health insurance program for people who have limited economic resources. Every state administers its own Medicaid program. While there are certain Medicaid benefits in all states, there are also differences between states.

For some states, Medicaid coverage for CPAP machines is similar to coverage provided by Medicare. You should check with your state’s Medicaid office for details about what related services are included and which providers participate in the Medicaid program.

Some people qualify for both Medicare and Medicaid, and Medicaid may help pay for out-of-pocket costs not covered by Medicare. For CPAP equipment, Medicare coverage would typically apply first with Medicaid potentially providing additional coverage.

Can You Pay for CPAP Equipment Without Insurance?

You can purchase CPAP equipment without insurance, but you need a prescription from a doctor to obtain a CPAP device.

Some CPAP suppliers sell or rent CPAP machines directly to individuals with a prescription. If you do not have or use insurance, you will have to pay full price to the supplier.

How much CPAP equipment costs out of pocket can vary based on the supplier and the details of your insurance policy. In many cases, having insurance can significantly reduce how much you have to pay.

That said, sometimes suppliers charge higher prices to insurance companies, which can mean higher costs if you have a high deductible or coinsurance. In certain situations, it may be less expensive to buy a CPAP machine and replacement supplies without insurance.

If you buy CPAP equipment without insurance, you will not have to provide data to your insurance company about how frequently you use your CPAP. If you find your own CPAP supplier, they may not have experience working with doctors, so ask in advance how they would communicate with your health care team if any questions or concerns arise about your device.